The return period of January and February 2020 have been redefined. 2018 shall be required to furnish the final return in Form GSTR-10 till December 31 2018.

Gst Filing Process How To E File Your Gst Return In Gst F5 Sg Small Business Center

Commissioner hereby extends the time limit for furnishing the return by a non-resident taxable person in FORM GSTR-5 for the months of July 2017 August 2017.

Faq About Gst Refund Rejection Order And Recredit Of Itc Under Pmt 03

Suggestions On Gst Portal Forms Functionalities Recent Changes

Gst Registration Can Be Cancelled For Not Furnishing Returns For A Continuous Period Of Six Months Kerala Hc Read Judgment Taxscan

Assessment By Gst Officer Keep An Eye Over The Taxpayer

Faq About Gst Refund Rejection Order And Recredit Of Itc Under Pmt 03

Faq About Gst Refund Rejection Order And Recredit Of Itc Under Pmt 03

Gst Input Tax Credit Blocked Credits Taxmann

Maldives Inland Revenue Authority Facebook

Faq About Gst Refund Rejection Order And Recredit Of Itc Under Pmt 03

Gst Return Filing Charges Service Types And Fees In India

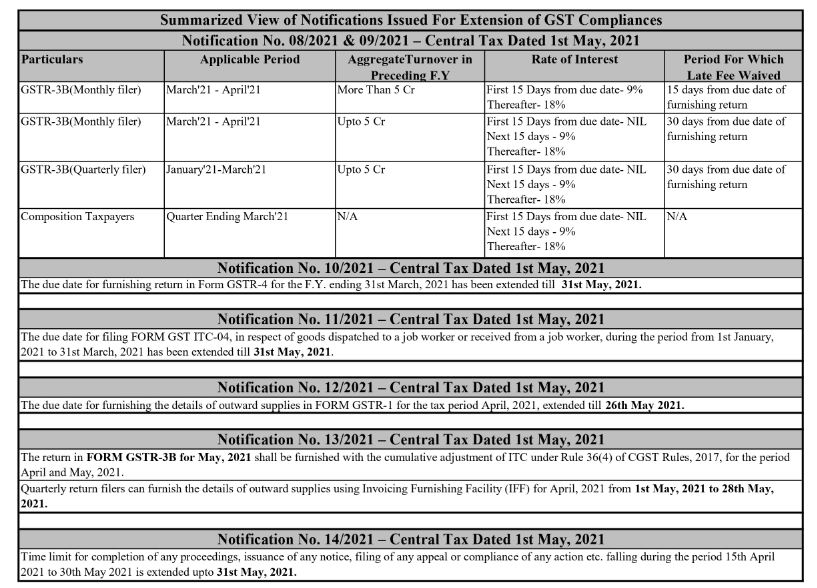

Gst Newest Notifications Cbic Gst Extension Notifications

Maldives Inland Revenue Authority Facebook

All About Gst Refunds A Reference Manual Version 2 0 1st July 2020